PMFME Seminar and Loan Mela by Ahmedabad Chamber of Commerce Welfare Fund

(ACC) and FEA – Innovative Food Entrepreneurs Associates

ThePradhan Mantri Formalisation of Micro food processing Enterprises (PMFME) Scheme

aims to enhance the competitiveness of existing individual micro-enterprises in the

unorganized segment of the food processing industry.

The Indian food processing industry has a wide variety of food products and the largest

production base.

There are over 25,00,000 food processing units in the fragmented food processing sector in

India, with 66% of them located in rural areas and over 80% owned by family-based

businesses providing an income source to rural communities.

However, these micro and small scale processing units face significant challenges.

The PMFME scheme supports those in food business with the following incentives:

- Food processing entrepreneurs through credit-linked capital subsidy @35% of the

eligible project cost with a maximum ceiling of Rs.10 lakh per unit. - Seed capital of Rs. 40,000/- per Self Help Group member for working capital and

purchase of small tools. - Credit linked grant of 35% for capital investment to farmer organisations, self-help

groups and cooperatives. - Support for marketing & branding to micro-units.

- Support for common infrastructure and handholding support to farmer and micro

business groups. - Providing Capacity building and training support to increase the capabilities of the

enterprises and upgradation of skills of workers. - Grants for development of common infrastructure including common processing

facility, lab, warehouse, etc. through FPOs/SHGs/cooperatives or state owned

agencies or private enterprise.

Since many IFEA members are in food processing sectors like dairy products, bakery,

frozen foods, beverages, etc, IFEA decided to plan the event with ACC after Rohit Khanna

and Anil Mulchandani spoke at an ACC seminar about the scheme.

The event was supported by Gujarat Agro Industries Corporation Ltd,

the nodal agency for the scheme in Gujarat.

A helpdesk was created where prospective applicants received information about the scheme and a list

of documents needed by them to avail the benefits of the credit-linked scheme. At the event venue,

booths were given to various banks associated with the scheme who could verify the documents and

advise the prospective applicant about the requirements to get the mandatory loans.

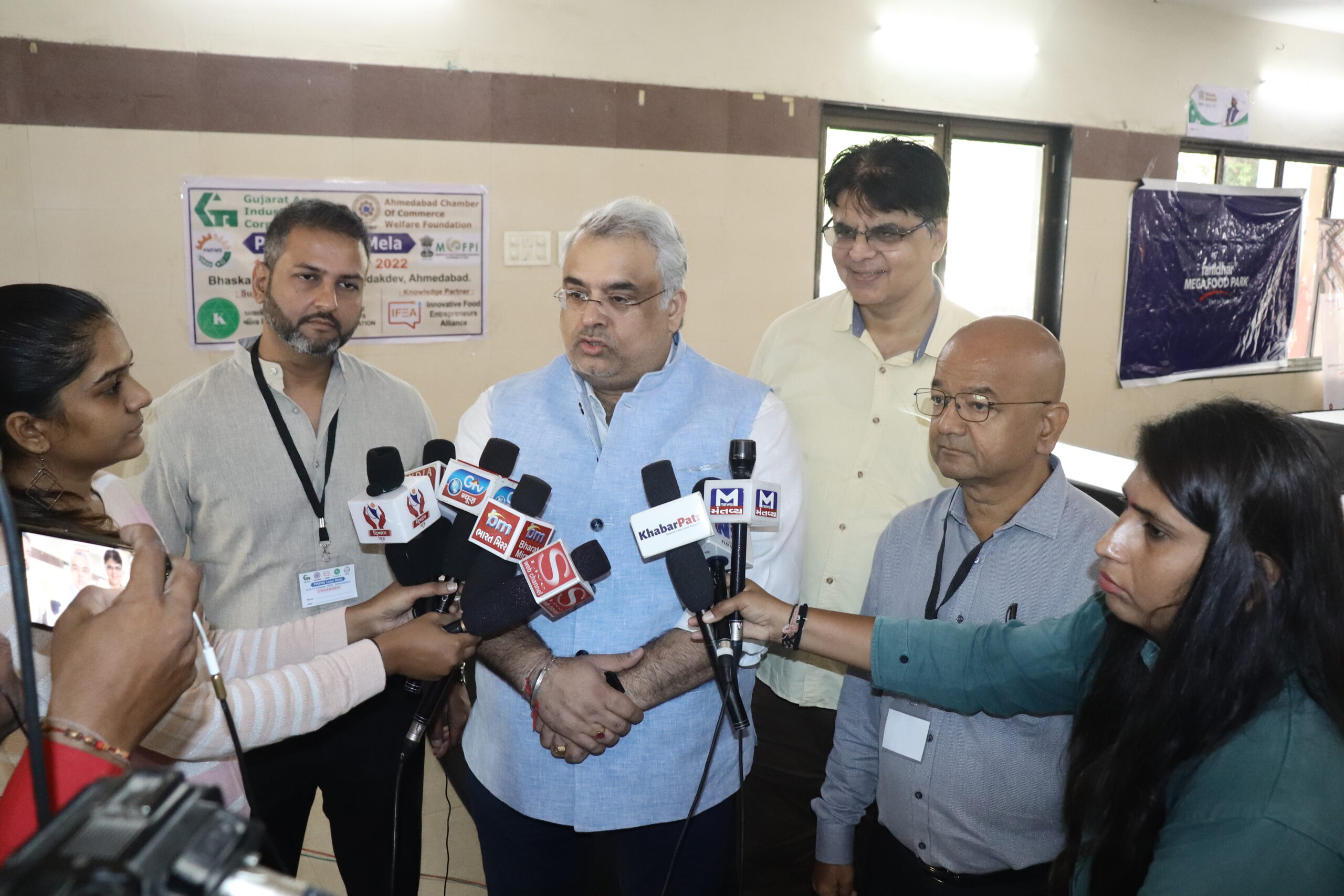

The event was well-covered by the local media.